Introduction:

Employee record

management is one of the most critical responsibilities of any HR department.

Accurate and well-maintained employee records form the backbone of smooth HR

operations, legal compliance, payroll processing, and employee trust. From

personal details and employment contracts to payroll data and performance

reviews, every record plays a vital role in organizational efficiency.

Poor employee record

management can lead to serious consequences such as compliance penalties,

payroll errors, data breaches, and employee dissatisfaction. In many cases,

organizations underestimate the importance of structured and secure

record-keeping until an audit, dispute, or legal issue arises.

The purpose of this

article is to highlight the most common mistakes in employee record

management and provide practical solutions and best practices to

help HR teams and businesses avoid these pitfalls while improving accuracy,

compliance, and efficiency.

What Is

Employee Record Management?

Definition and Scope:

Employee record

management refers to the systematic process of collecting, storing,

maintaining, updating, and securing employee-related information throughout the

employee lifecycle—from hiring to exit.

Types of Employee

Records:

Employee records

typically include:

- Personal records: Name, address, contact details,

identity proofs - Payroll records: Salary, tax details, bank

information, payslips - Performance records: Appraisals, feedback, promotions

- Compliance records: Attendance, leave, statutory

forms, contracts, disciplinary actions

Who Is Responsible for

Managing Records?

HR professionals are

primarily responsible for employee record management, often in coordination

with payroll teams, compliance officers, and IT departments to ensure data

accuracy, security, and legal adherence.

Why Employee Record

Accuracy Matters:

Legal and Statutory

Compliance:

Accurate employee

records help organizations comply with labor laws, tax regulations, and

statutory requirements. Incorrect or missing records can result in penalties,

audits, and legal disputes.

Smooth HR Operations

and Audits:

Well-organized records

ensure smooth onboarding, payroll processing, internal audits, and external

inspections, saving time and reducing stress.

Employee Satisfaction

and Dispute Prevention:

Employees trust

organizations that manage their data responsibly. Accurate records prevent

salary disputes, leave miscalculations, and miscommunication.

Data-Driven HR

Decision-Making:

Reliable employee data

enables informed HR decisions related to workforce planning, promotions,

training, and performance management.

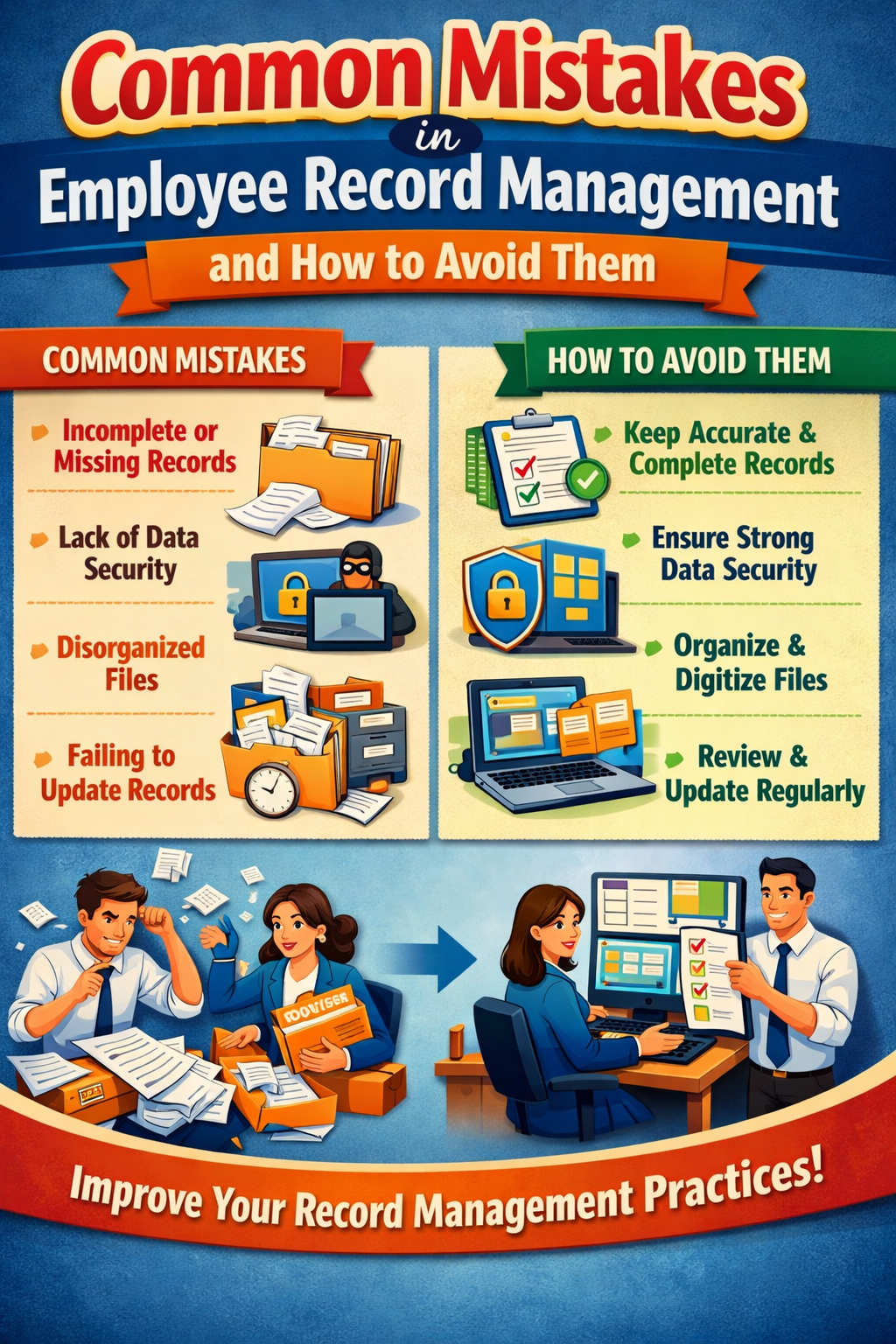

Common Mistake #1: Incomplete

Employee Records:

Missing Documents and

Information:

Incomplete records

often include missing identity proofs, signed contracts, tax declarations, or

emergency contact details.

Risks of Incomplete

Records:

- Compliance violations

- Payroll delays or errors

- Legal exposure during disputes

How to Avoid This

Mistake:

- Use standardized onboarding

checklists - Verify documents before employee

confirmation - Conduct regular record completeness

audits

Common Mistake #2: Manual and

Paper-Based Record Keeping:

Limitations of Physical

Files and Spreadsheets:

Paper files and

spreadsheets are time-consuming, prone to errors, and difficult to scale as the

organization grows.

Risks of Data Loss and

Errors:

- Misplaced files

- Data duplication

- Lack of real-time updates

Transitioning to

Digital HR Systems:

Adopting an HRMS

(Human Resource Management System) allows centralized, searchable, and

secure storage of employee records.

Common Mistake #3: Poor Data

Security and Access Control:

Unauthorized Access

Issues:

Without proper access

controls, sensitive employee data may be accessed by unauthorized personnel.

Data Breaches and

Confidentiality Risks:

Data breaches can

damage company reputation and lead to legal consequences.

Best Practices for Data

Protection:

- Role-based access controls

- Data encryption

- Secure login authentication

- Regular security audits

Common Mistake #4: Failure to Update Employee

Records Regularly:

Outdated Personal and

Employment Details:

Employee information

such as address, bank details, job role, or salary often changes but remains

unupdated.

Impact on Payroll,

Compliance, and Communication:

Outdated data can

result in incorrect payments, compliance issues, and communication gaps.

Setting Update

Schedules and Reminders:

- Schedule quarterly or annual record

updates - Use automated reminders

- Enable employee self-service

updates

Common Mistake #5: Lack of Standardized Record

Management Processes:

Inconsistent Data

Formats and Storage:

Different departments

may follow different formats, leading to confusion and inconsistency.

Problems During Audits

and Reporting:

Inconsistent records

make audits, reporting, and analysis difficult and error-prone.

Creating Standard HR

Documentation Procedures:

- Define standard templates

- Maintain uniform naming conventions

- Document clear SOPs for record

management

Common Mistake #6: Non-Compliance with Legal

Retention Requirements:

Ignoring Statutory

Record Retention Periods:

Many organizations fail

to retain employee records for the legally required duration.

Risks of Penalties and

Legal Disputes:

Non-compliance can

result in fines, legal action, and loss of credibility.

Understanding Labor

Laws and Compliance Timelines:

HR teams must stay

updated with labor laws and define clear record retention and disposal

policies.

Common Mistake #7: No Backup or

Disaster Recovery Plan:

Data Loss Due to System

Failure or Accidents:

Without backups, system

crashes, cyberattacks, or natural disasters can wipe out critical data.

Importance of Regular

Backups:

Regular backups ensure

business continuity and data recovery.

Secure Backup and

Recovery Strategies:

- Cloud-based backups

- Automated backup schedules

- Periodic recovery testing

Best Practices for Effective

Employee Record Management:

Use of HRMS / Digital

Record Systems:

Digital HR systems

streamline data storage, retrieval, and updates while improving accuracy.

Regular Audits and Data

Verification:

Conduct periodic audits

to identify errors, gaps, or compliance risks.

Employee Self-Service

Portals:

Allow employees to view

and update their information, reducing HR workload and improving accuracy.

Training HR Staff on

Compliance and Data Handling:

Continuous training

ensures HR teams understand legal requirements and best data-handling

practices.

Role of Automation in

Employee Record Management:

Automated Data Entry

and Updates:

Automation reduces

manual errors and ensures real-time data accuracy.

Integration with

Payroll and Attendance Systems:

Integrated systems

eliminate duplication and ensure seamless payroll processing.

Error Reduction Through

Automation:

Automated validations

and workflows significantly reduce human errors and compliance risks.

Conclusion:

Employee record

management is not just an administrative task—it is a strategic HR function

that directly impacts compliance, payroll accuracy, operational efficiency, and

employee trust. Common mistakes such as incomplete records, manual processes,

poor security, and non-compliance can expose organizations to serious risks.

By adopting digital HR

systems, standardizing processes, ensuring regular updates, and leveraging

automation, businesses can build a reliable and compliant employee record

management system.

Final Recommendation:

HR teams and businesses should prioritize structured, secure, and automated

employee record management practices to ensure long-term organizational

success, legal compliance, and a positive employee experience.