Introduction:

In today’s competitive

job market, understanding the HR salary

structure is essential for both employees and employers. Compensation is

not just about the monthly paycheck—it directly influences employee motivation,

job satisfaction, retention, and overall performance.

For HR professionals,

having clarity about fixed pay,

variable pay, and employee benefits is crucial because HR plays a dual

role: managing their own compensation expectations while also designing salary

structures for the entire organization.

A well-designed HR

salary structure ensures fairness, compliance with labor laws, and alignment

with business goals. This blog explains the complete HR salary structure,

including fixed pay, variable pay, statutory benefits, and future compensation

trends, in a clear and practical manner.

What Is an HR

Salary Structure?

An HR salary

structure refers to the organized breakdown of compensation paid to HR

professionals. It defines how much an employee earns, how it is paid, and what

additional benefits are included.

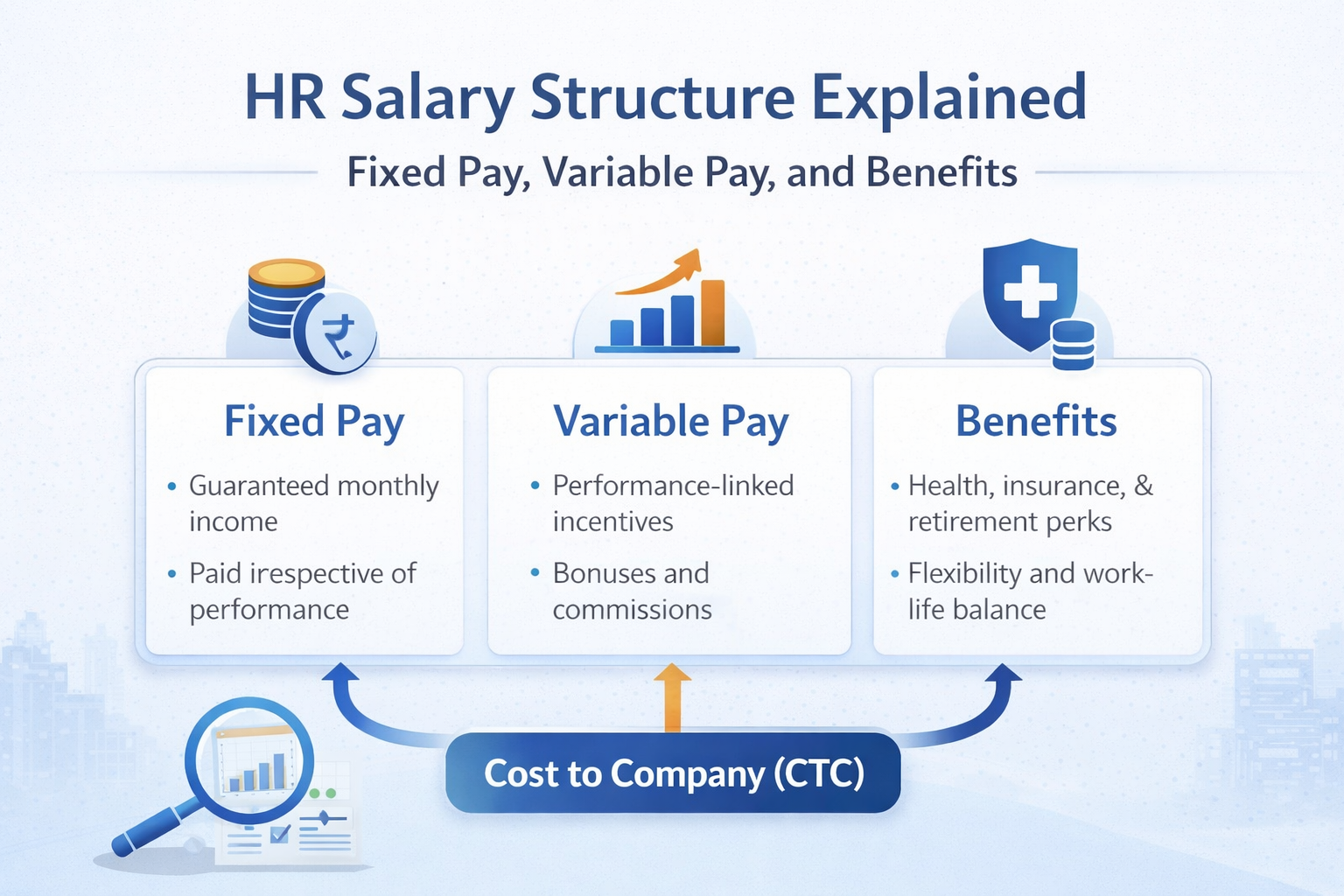

Components of Cost to

Company (CTC)

CTC (Cost to Company)

is the total amount an employer spends on an employee annually. It includes:

- Fixed pay

- Variable pay

- Statutory benefits

- Non-statutory benefits

Difference Between

Gross Salary, Net Salary, and CTC

- CTC: Total cost incurred by the

employer - Gross Salary: Salary before deductions like PF

and tax - Net Salary (Take-Home Pay): Amount received after deductions

Understanding these

differences helps HR professionals communicate compensation clearly and avoid

misunderstandings.

Fixed Pay: The Stable Component of HR

Compensation:

3.1 What Is Fixed Pay?

Fixed pay is the guaranteed portion of salary paid monthly,

regardless of performance. It provides income stability and forms the

foundation of the HR salary structure.

3.2 Common Components

of Fixed Pay

1. Basic Salary

o Core component of salary

o Basis for PF, gratuity, and other benefits

2. House Rent Allowance (HRA)

o Provided to meet rental expenses

o Tax benefits available under the Income Tax Act

3. Dearness Allowance (DA)

o Adjusts salary for inflation

o Common in government and PSU roles

4. Special Allowance

o Flexible component to balance salary structure

5. Conveyance Allowance

o Supports daily commuting expenses

3.3 Importance of Fixed

Pay in HR Roles

Fixed pay ensures:

- Financial stability

- Compliance with labor laws

- Predictable statutory deductions

- Employee trust and security

For HR professionals,

stable fixed pay is essential since their role involves long-term

organizational planning.

Variable Pay:

Performance-Linked Earnings:

4.1 What Is Variable

Pay?

Variable pay is linked to individual, team, or company

performance. It may be paid monthly, quarterly, or annually and is designed to

reward results.

4.2 Types of Variable

Pay in HR

1. Performance Bonus

o Based on annual or quarterly appraisals

2. Recruitment Incentives

o Linked to hiring targets and closures

3. Retention or Engagement Incentives

o Focused on reducing attrition

4. Profit-Sharing Bonuses

o Paid when the organization performs well

4.3 Advantages and

Challenges of Variable Pay

Advantages

- Boosts motivation

- Encourages productivity

- Aligns employee goals with business

objectives

Challenges

- Income uncertainty

- Difficult performance measurement

- Risk of bias if criteria are

unclear

A transparent variable

pay system is critical for its success.

Employee Benefits: Beyond Cash Compensation:

5.1 Statutory Benefits

These benefits are

legally mandated in India:

- Provident Fund (PF)

- Employee State Insurance (ESI)

- Gratuity

- Bonus (as per applicable laws)

Compliance with

statutory benefits protects both employer and employee.

5.2 Non-Statutory

Benefits

These benefits improve

employee experience:

- Health and life insurance

- Paid leave and holidays

- Learning and development programs

- Flexible work options and remote

work

Modern HR salary

structures focus heavily on these benefits to enhance retention.

Typical HR Salary Structure by

Role & Experience:

HR Fresher / Executive

- Higher fixed pay ratio

- Limited variable pay

- Focus on learning benefits

HR Generalist /

Recruiter

- Moderate variable pay

- Hiring-based incentives

- Performance-linked bonuses

HR Manager

- Balanced fixed and variable pay

- Leadership and retention incentives

- Enhanced benefits

Senior HR / HR Head

- Strategic variable pay

- Profit-sharing and long-term

incentives - Comprehensive benefits package

Factors Affecting HR

Salary Structure:

Several factors

influence HR compensation:

- Experience and qualifications

- Industry and company size

- Location (metro vs non-metro)

- Skills like HR analytics, HR tech,

labor law compliance

Professionals with

specialized HR skills often command higher salaries.

Designing a Balanced HR

Salary Structure:

An effective HR salary

structure should focus on:

- Internal equity: Fair pay across roles

- External equity: Market competitiveness

- Legal compliance: Adherence to labor laws

- Business alignment: Supporting company goals

Benchmarking and salary

surveys play a key role in achieving balance.

Common Mistakes in HR

Salary Structuring:

- Overloading fixed pay, reducing

flexibility - Unclear variable pay criteria

- Ignoring statutory compliance

- Lack of transparency in CTC

communication

Avoiding these mistakes

builds trust and reduces attrition.

Future Trends in

HR Compensation:

The future of HR salary

structures includes:

- Pay-for-performance models

- Skill-based and role-based pay

- AI-driven compensation planning

- Flexible benefits and total rewards

approach

HR professionals must

stay updated to remain relevant in 2026 and beyond.

Conclusion:

A well-designed HR

salary structure balances fixed pay, variable pay, and benefits

while ensuring fairness, transparency, and legal compliance.

For HR professionals

and employers, clarity in compensation builds trust, improves performance, and

supports long-term organizational growth. By adopting modern compensation

practices and focusing on total rewards, organizations can attract, retain, and

motivate top HR talent effectively.